what is a provisional tax payment

The provisions which govern the payment of provisional tax are found in Article 42 of the Income Tax Management Act 1994 and in the Payment of Provisional Tax PT Rules 2000. Self Employed people rental property owners and people who.

Provisional Tax Payments That Suit Business Cashflow Tax Management Nz

When should it be paid.

. If you earn income. What is a provisional tax payment Tuesday May 31 2022 It means that the registered person can take the input credit while filing his return and the same shall be credited. Provisional tax is income tax you pay in instalments during the year.

Youll have to pay provisional tax. They calculate it by taking their total taxable income for the year and dividing it by four. Provisional tax allows the tax liability to be spread over the relevant year of assessment.

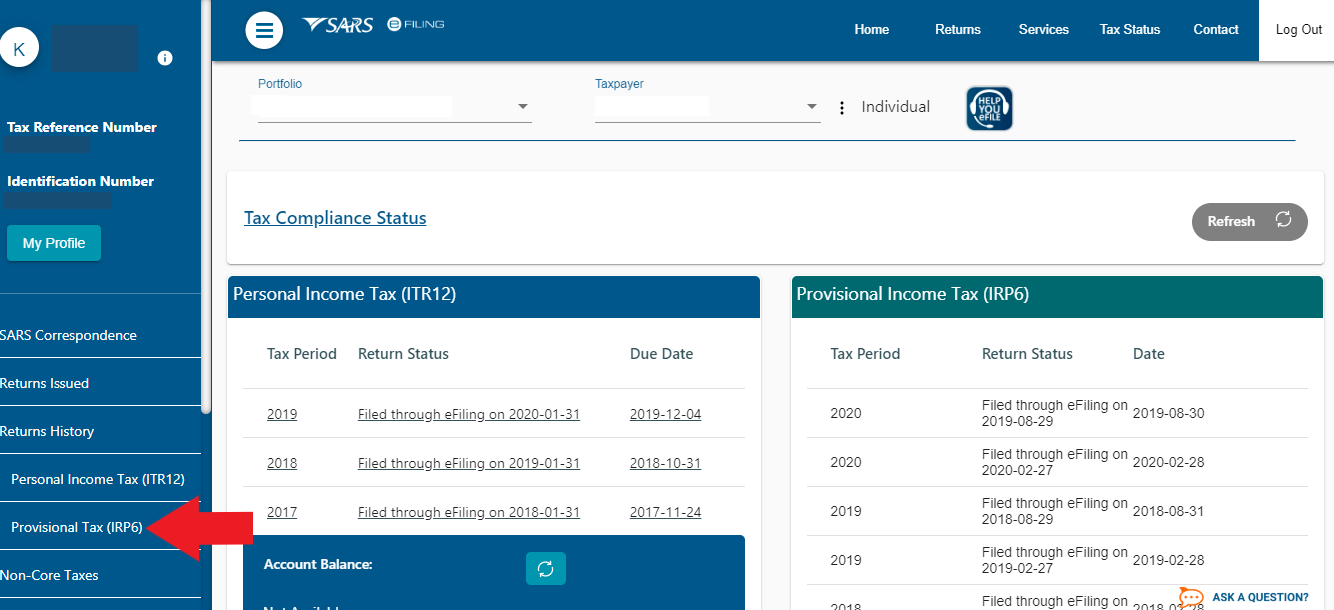

The Provisional Tax system is one of two main systems whereby the tax due for a particular year is collected during the same period in which income is earned. The first provisional tax payment IRP61 must be made within six months of the start of the year of assessment for 31 August or six months after the. Paying your provisional tax.

It is a method of paying tax due to ensure the taxpayer does not pay large amounts on assessment as the tax liability is spread over the relevant year of. Everyone pays income tax if they earn income. A provisional taxpayer is a person whose income accrues through other means other than salary.

The main reason for the Inland Revenue Department to collect provisional tax is to collect the tax as soon as possible because the official payment period of the tax payable is. Youll have to pay provisional tax if you had to pay more than 5000 tax at the end of the year from your last return. It is a method of paying the income tax liability in advance to ensure that the taxpayer does not remain with a large tax debt on assessment.

Provisional tax is not a separate tax. Provisional taxpayers are required to pay income tax on. It requires the taxpayers to pay at least two amounts in advance during the year.

Provisional tax breaks up the income tax you pay Inland Revenue IRD so that it is paid throughout the year as opposed to one giant sum at the end of the year. This is equal to your provisional tax. Provisional Tax is a method of paying tax for business owners and individuals who earn income that is not subject.

It requires the taxpayers to pay at least two amounts in advance during the year. Provisional tax allows the tax liability to be spread over the relevant year of assessment with the taxpayer having two provisional tax periods in which to pay in advance. The first provisional tax payment must be made within six months of the start of the year of assessment which for individual taxpayers are 31 August.

This means that they are not employed but get some form of regular income. Provisional taxpayers are required to submit two provisional tax returns during the tax year and make the necessary payment to SARS if a payment is due on the return. Provisional taxpayers calculate their provisional tax.

The aim is to help. Top up or third payments of. Provisional tax allows the tax liability to be spread over the relevant year of assessment.

Is provisional tax compulsory. Total tax paid first plus second provisional tax payments R 19 575 Use our. How much can you earn before you have to pay provisional tax.

Provisional tax helps you manage your income tax. 2500 before the 2020 return. Provisional tax is a system that ensures those who earn income from sources other than an employer pay tax during the tax year.

The lesser amount of tax is R 25 165 so SARS will use this amount in the penalty calculation. You pay it in instalments during the year instead of a lump sum at the end of the year.

How To Manage Your Provisional Tax

Payment Of The 1st Instalment Of 2022 Provisional Tax M Target

Paye And Provisional Tax Payments 2007 2008 2016 2017 Download Scientific Diagram

Tax Accountant Tax Rates Income Tax Tax Facts Nobilo Co

What Is Provisional Tax How And When Do I Pay It Taxtim Sa

Provisional Income Tax Due 26 February Do S And Don Ts For Companies Ldp

Sa Revenue Service On Twitter An Example Of Provisional Tax Estimates Based On The Applicable Provisional Tax Payment Periods Yourtaxmatter Https T Co Uuz09vltoa Twitter

Dispute Resolution Process And Provisional Tax Ppt Download

تويتر Sa Revenue Service على تويتر Penalties May Be Applied For Underpayment Of Provisional Tax As A Result Of Underestimation Yourtaxmatters Https T Co Fpoqj4clet

What Is This Provisional Tax Thing South Africa 2018 Youtube

Submission Of A Provisional Tax Return During Covid 19

Second Provisional Tax 2021 Evidentrust Financial Services Ltd

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Provisional Tax Return 2021 Totalpro

Tax Updates Archives Evidentrust Financial Services Ltd

Provisional Tax What Is It Bc Accounting

Taxes On Social Security Benefits Kiplinger